ITV’s annual report was released last week. I always find these interesting, often more for the information that’s not included, rather than the info that is!

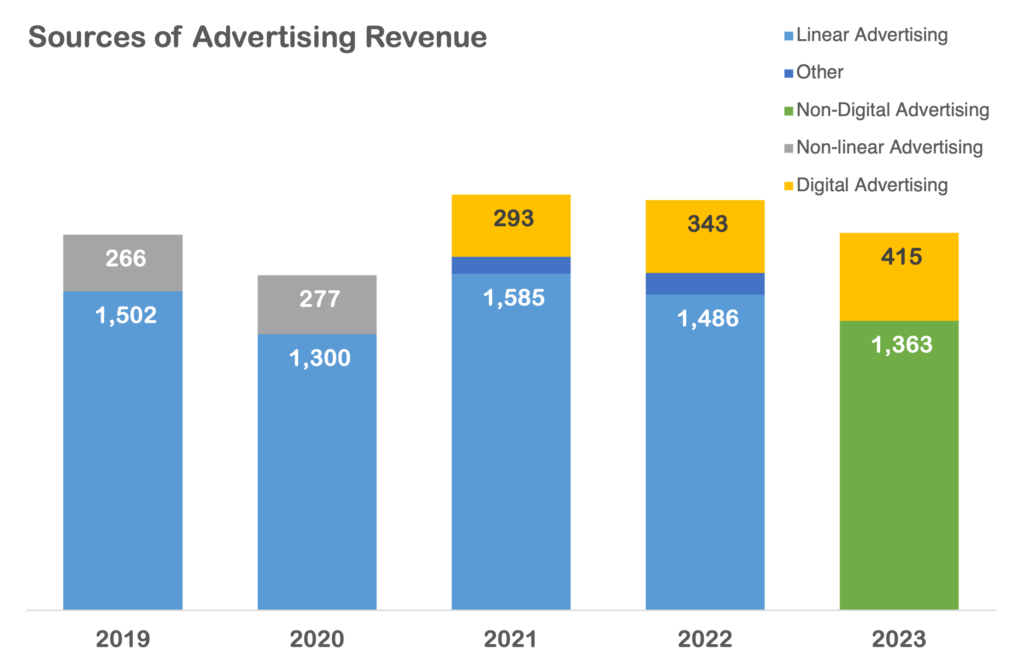

Last year ITV very helpfully included data on linear advertising revenues (‘Linear Remains Resilient’). With declining resiliency, they’ve opted not to do that this year but we can still piece together the picture. Linear will have delivered nearly £1,363m in 2024, not far above 2020’s Covid ridden performance. Q1.24 is apparently better, 3% up YoY (although 23 is a shitty baseline). We won’t see their detailed quarterly phasing for a couple of months, but if they’re hitting their projected 15% increase in digital income, this would probably still see a marginal YoY decline in linear.

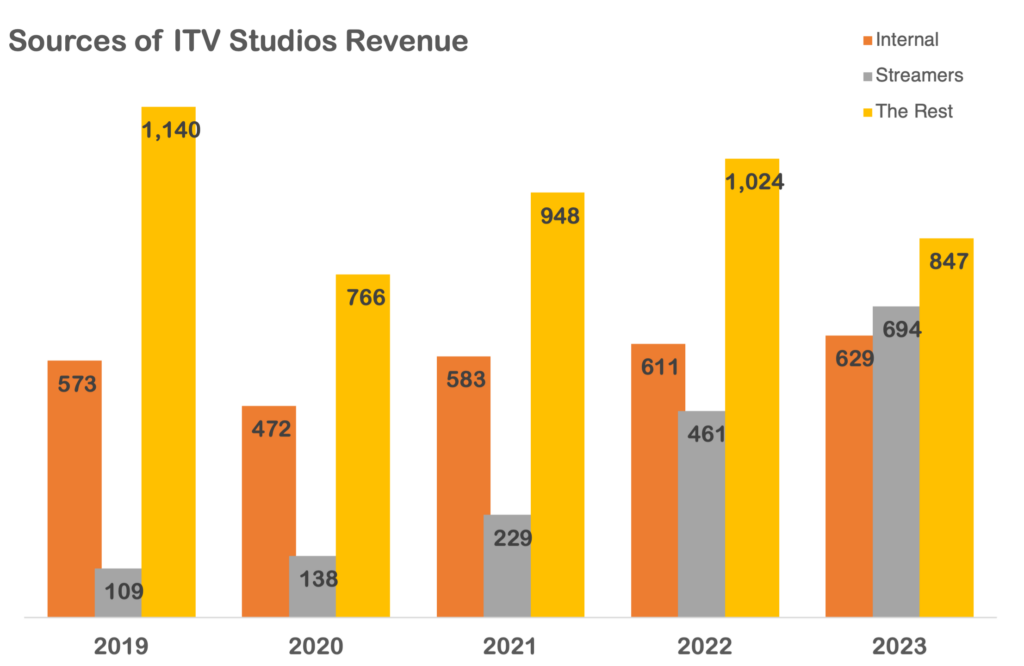

ITV Studios is without doubt a success story for ITV, growing substantially over recent years. They called out growth they needed with global streamers, and they’re hitting their target. They also produce a lot for their own internal channels but it was everything else they produce which I found interesting. 2023 saw a 17% decrease YoY in revenue from other (non-internal, non-streamer) broadcasters. From the chart it’s not a clear trend, at best you could call it ‘volatile’. But revenue diversity is important and it will be interesting to see how this develops.

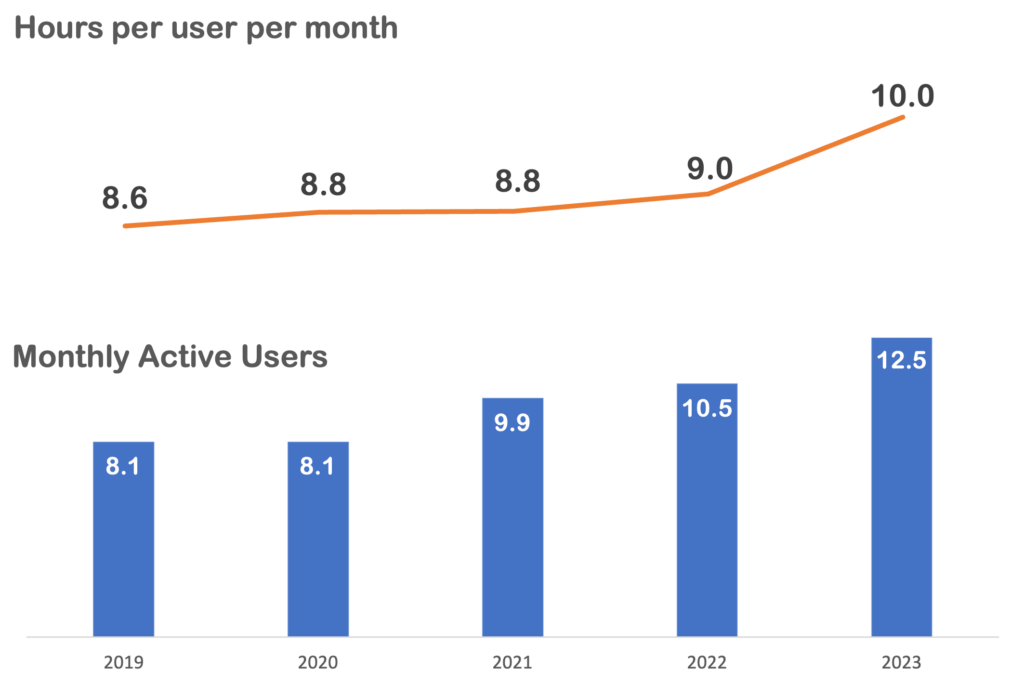

ITVX growth has also been impressive. Growing to 12.5m monthly active users with each user watching incrementally more! Sadly I don’t have full access to BARB anymore but you can pull together a reasonable proxy for linear from publicly available data. By my reckoning, ITV’s linear Monthly Active Users (or reach) in 2023 was 45m and they streamed a total of nearly 8Bn hours, or the equivalent of 14 hours per user per month. Compared against the 12.5m MAUs streaming 10 hours a month on their digital service.

I have 2 perspectives on this..

- If you consider how much revenue is generated for each platform, that makes a digital hour (£0.33) nearly twice as valuable as a linear hour (£0.17). This is impressive and makes sense, with a more engaged and younger audience switching to digital first, coupled with an enhanced ad product. You would expect this differential to reduce as reach expands but I don’t think you’ll lose it all! There is also a potential Newtonian impact to consider, with linear audiences devaluing as higher value (engaged / younger) audiences migrate online

- Secondly, ever since i can remember, ITV has been a massive and ubiquitous media presence; 45m (70%+) monthly reach . As the move to digital accelerates what will be the impact on the brand and particularly their ad business as they transition to become one of many niche (is that too harsh?) suppliers of admittedly excellent long-form content. How large can a walled garden owned platform grow on a £1.3Bn content spend?

So what would I do?

Honestly, i think ITV are doing a really good job but this is where i’d look to enhance their plan…

- I’m not sure there’s anything you can do about linear, there’s only so much you can do within a market that’s turned. If they can continue to replace linear with more effective digital revenues then shareholders should be happy.

- The growth in Studios has been really impressive, but if you dig in to an average consumers viewing day (4hrs 28 of video mins consumed daily), ITV Studios is only addressing 74% of the market (52% looking at 1634s). Video sharing platforms are becoming increasingly dominant and any major supplier of content should be figuring out how to supply content into that space too. There should be (maybe there already is tbh) a target on non-longform, potentially non-video content production. Whilst naturally easier to monetise audiences effectively on ITVX I would set targets and budgets to create bespoke scripted and non-scripted content for social platforms to learn how to deliver compelling stories in new ways, how to monetise them effectively, and also to up-skill Studios and create a calling card for more non-traditional 3rd party service work.

- It’s great they called out the News experience on mobile, this feels like a real opportunity! There’s some bespoke presentation on TikTok, but it leans towards to the more pop-culture end of the news. ‘Proper’ news still seems to be mostly grey suits behind a desk, clipped from the linear programme. It’s time to lean into their established quality journalism, and really play with presentation of news across new platforms to adapt it for new and younger audiences (I don’t mean just having a presenter with scruffy jeans!).

- Content is always king, but i’m afraid an Oscars live event and Celebrity Big Brother don’t cut it as tent pole events to ‘supercharge streaming’. M&E EBITDA margins may be challenged (<10% in 2023) but they need to capitalise on the momentum they have with ITVX. Interestingly both Netflix and Amazon having been diving into sport as a important genre for streamers and it scratches an itch for many that can’t easily be replaced with other forms of content. ITV have a strong sporting heritage and I would be looking to potentially invest in this as a route to drive more viewers into ITVX.